RESEARCH:

Using AI to Read SEC Filings

Alexandria builds domain specific and media specific artificial intelligence which outperforms larger generic models. SEC filings can provide investors with insights into a company’s financial health, operational risks, as well as forecast future financial results. By using Natural Language Process (NLP) that has been trained specific to these document types, we can instantaneously classify vast amounts of information into structured data that includes topics, themes as well as sentiment, which we can use to help make more informed decisions in systematic trading strategies.

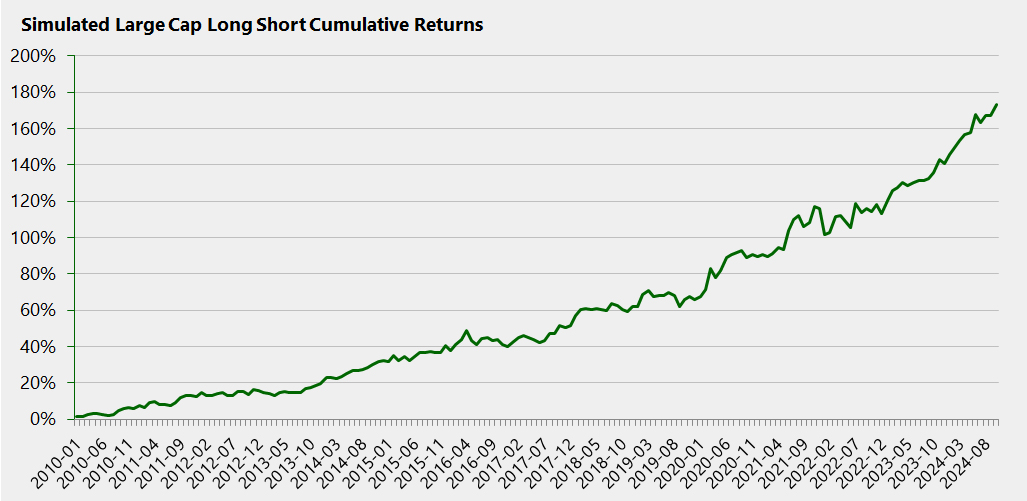

A long short strategy created from ranking SEC filings for sentiment provides superior risk adjusted returns, achieving an out of sample Sharpe Ratio of 1.16, with recent years performing particularly well.

The dataset compromises an impressive volume of filings from US based companies. The history of the dataset spans from present day back to January 1, 2000. The data is broken down into the following metrics:

• 20,929 Unique Companies

• 729,182 Filings (10-K + 10-Q)

• 7,091,108 Sections within the Filings

• 690,000,000+ Sentences