RESEARCH:

Inflation & Supply Chain Impact on Company Earnings

How Is Inflation & Supply Chain Affecting Company Earnings and Stock Price Performance?

Alexandria Technology uses machine learning to systematically analyze thousands of earnings calls every quarter with the precision and accuracy of a seasoned analyst. The results are compelling: Alexandria’s top 100 ‘best’ calls have returned +19.4% over the last 10 years, outperforming the S&P 500 by over 6.5% annually as shown below. Institutional investors use this to incorporate actionable data within their investment processes and generate meaningful additional alpha.

Inflation & Supply Chain Themes Deep Dive

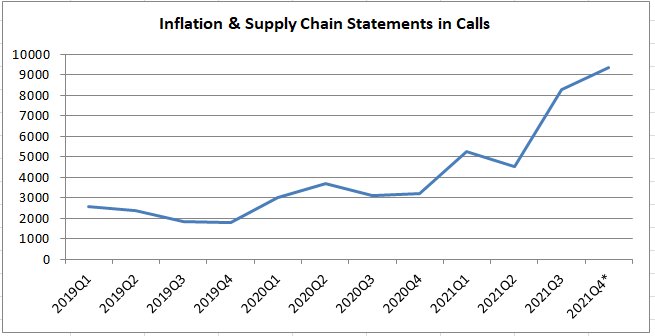

With inflation and supply chain garnering significant headlines and attention from Wall Street, we dug into our data to explore these themes in more granular detail. First, we looked at every Earnings Call for every company within the S&P 500 over the last three years (Q1 2019 through Q4 2021). As illustrated in the chart below, the number of Inflation and Supply Chain statements has grown dramatically over the last few quarters, spiking to over 9,000 mentions in the 4th quarter of last year.

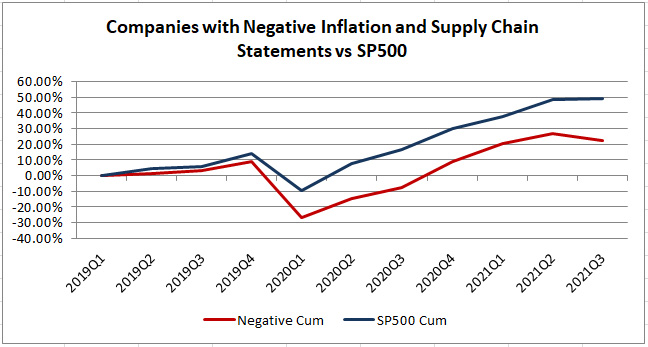

Furthermore, we are able to pinpoint which of each of these mentions is positive versus negative. Why does this matter? As shown below, at a macro level, those companies with 'negative' inflation and supply chain statements underperform the S&P 500 by a wide margin.

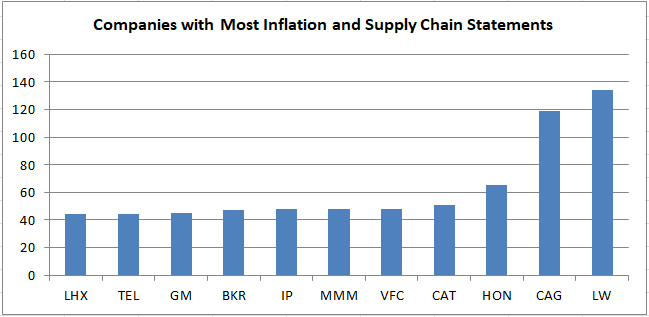

And finally, we can get more granular, drilling into the company level to identify those companies with the most supply chain mentions.

Turn an Information Challenge into an Information Edge

Leverage Alexandria Earnings Calls to capture earnings insights that move markets every stock in your investment universe. Leverage deep thematic sentiment to pinpoint positive vs. negative calls, quickly see the biggest themes from a call, and systematically identify earnings winners versus losers.