RESEARCH:

Analyzing Forward Looking Statements in Earnings Calls

Alexandria builds domain specific and media specific artificial intelligence which outperforms larger generic models.

Earnings call sentiment has been documented as an orthogonal source of alpha. Why do calls contain such slow alpha decay and long term drift? One theory is the forward looking statements made in calls. While earnings surprise can capture beats and misses for the most recent quarter end, it lacks information about the future.

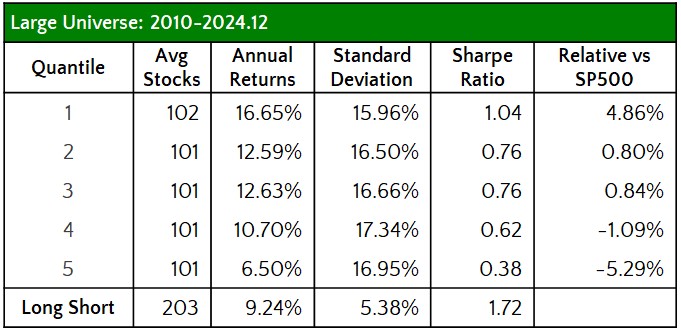

We use NLP to classify forward statements with very significant results. While sentiment for the entire call can produce Sharpe Ratios of 1.2 and above for a long short portfolio with monthly rebalance, isolating forward statements increases the Sharpe Ratio to 1.72

For more information, request one pager or schedule a call using the request form on the right panel.

For more information, request one pager or schedule a call using the request form on the right panel.